我的2019 financial accounting学习计划。

MATERIAL: Financial Accounting: Introduction level by UPenn, Coursera, Professor Brian Bouche

week 3

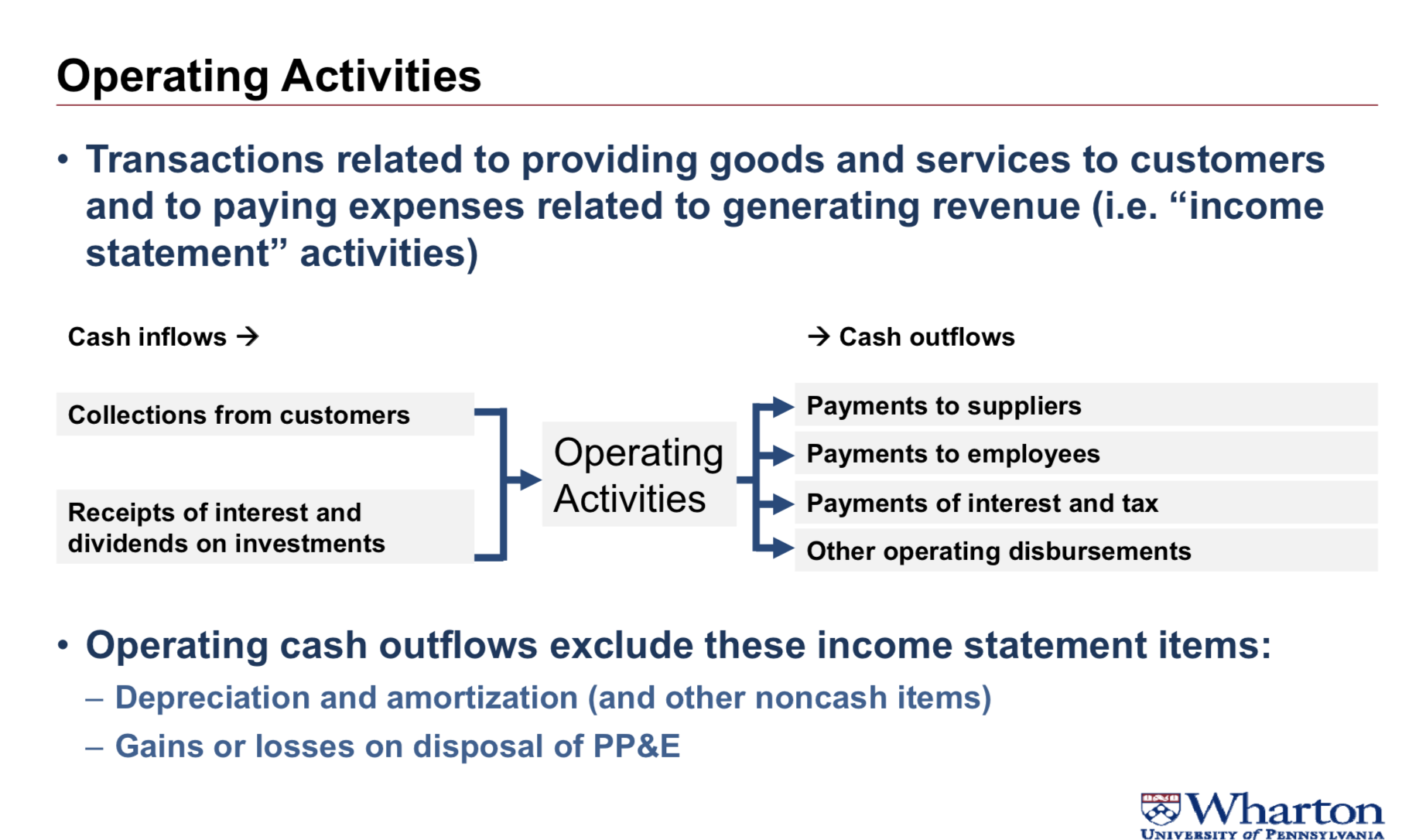

Operating, Investing, and Financing Cash Flows

Reports changes in cash due to operating, investing, and financing activities over a period of time (a period like a fiscal quarter or a fiscal year, any period between two balance sheet dates.)

• Statement of Cash Flows format:

Net cash from operating activities

- Net cash from investing activities

- Net cash from financing activities

= Net change in cash balance

• Non-cash transactions are disclosed at the bottom of the statement

• Cash interest paid and cash income taxes paid must also be disclosedOperating cash flow

interest and dividends on investments because these items also appear on the income statement. And the Financial Accounting Standards Board, the FASB decided that they wanted them as part of the operating cash flow.

Some adjustments:

on the income statement but not part of cash operating activities

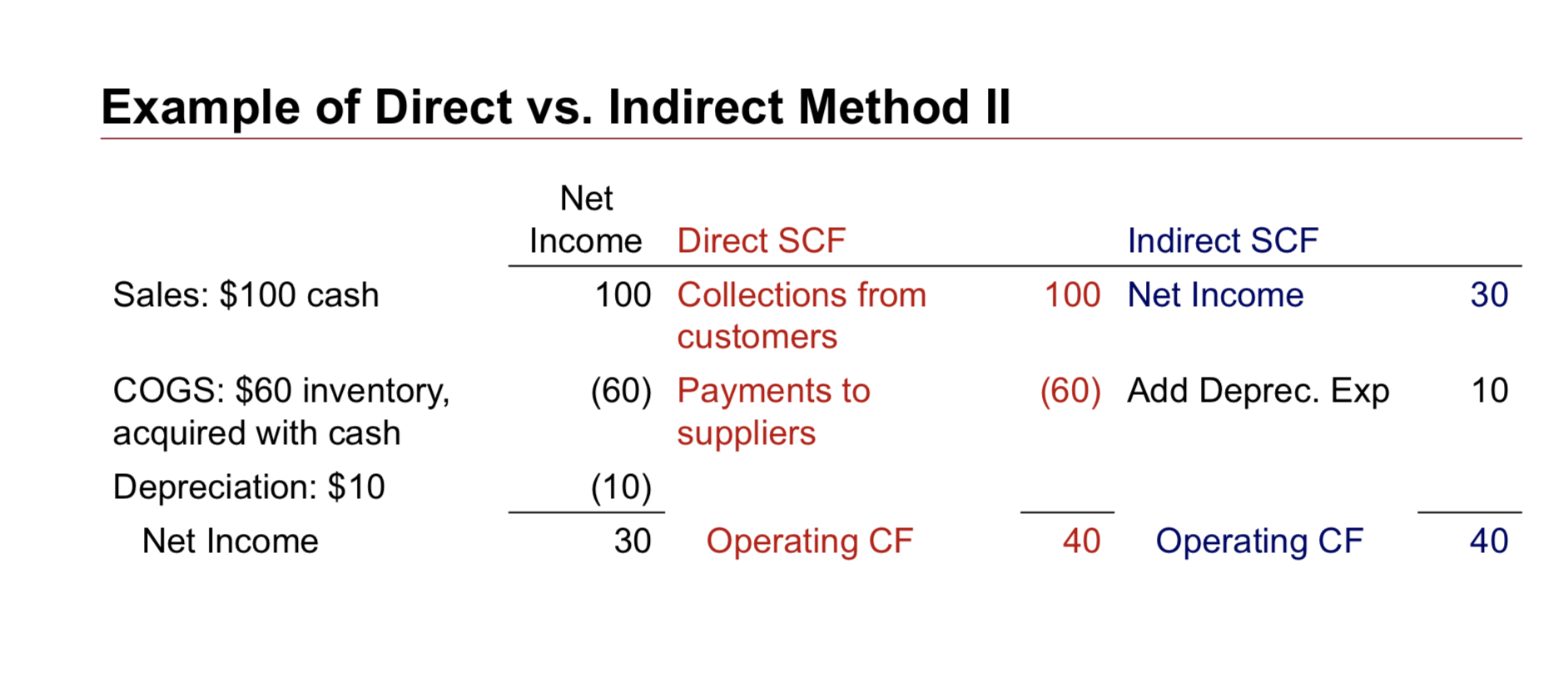

1 depreciation and amortization(and other noncash items)

2 gains or losses on PP&E we don’t want to show the cash flow in the operating activities section, we want to show it in investing activities section.

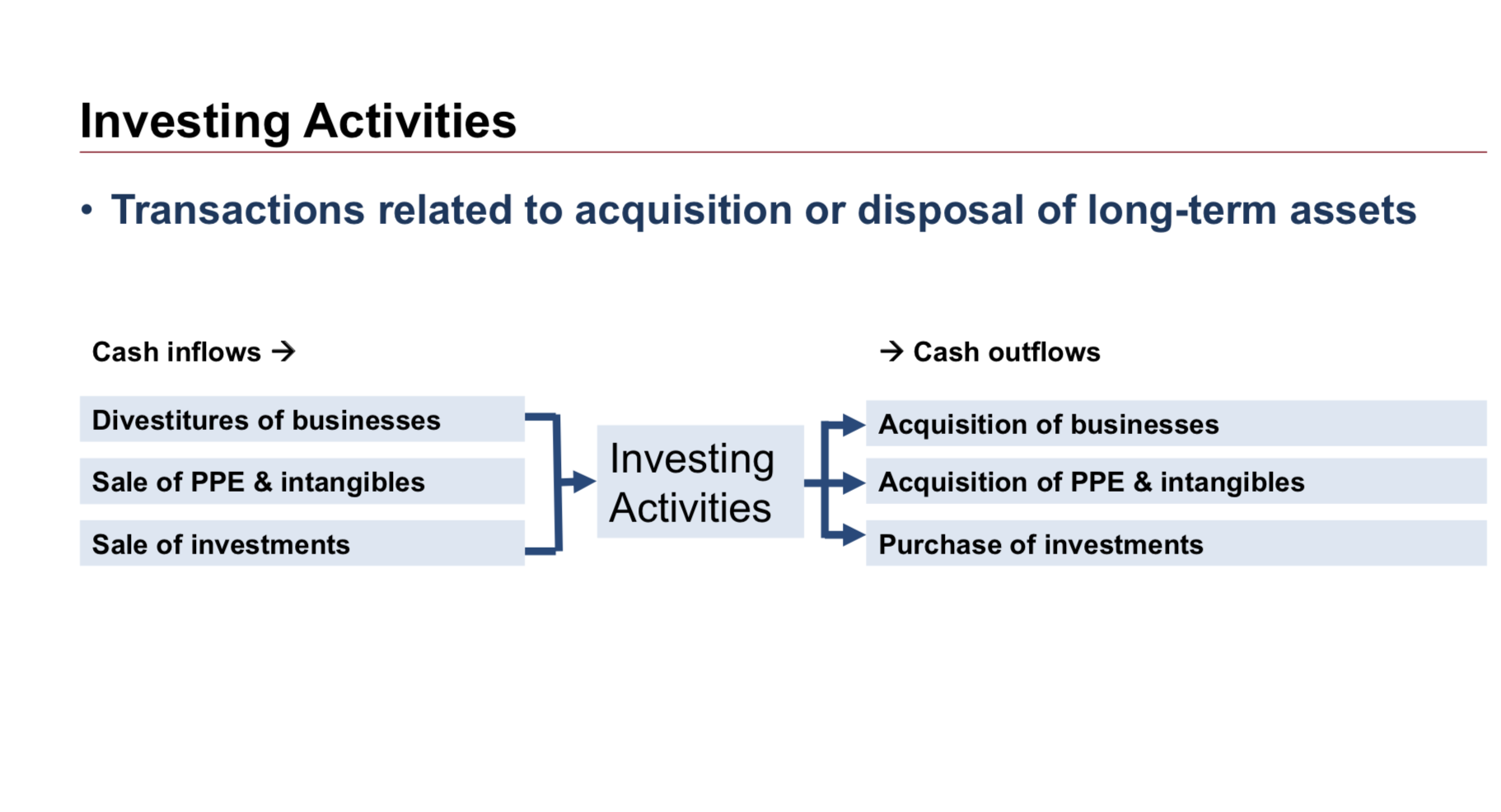

investing cash flows

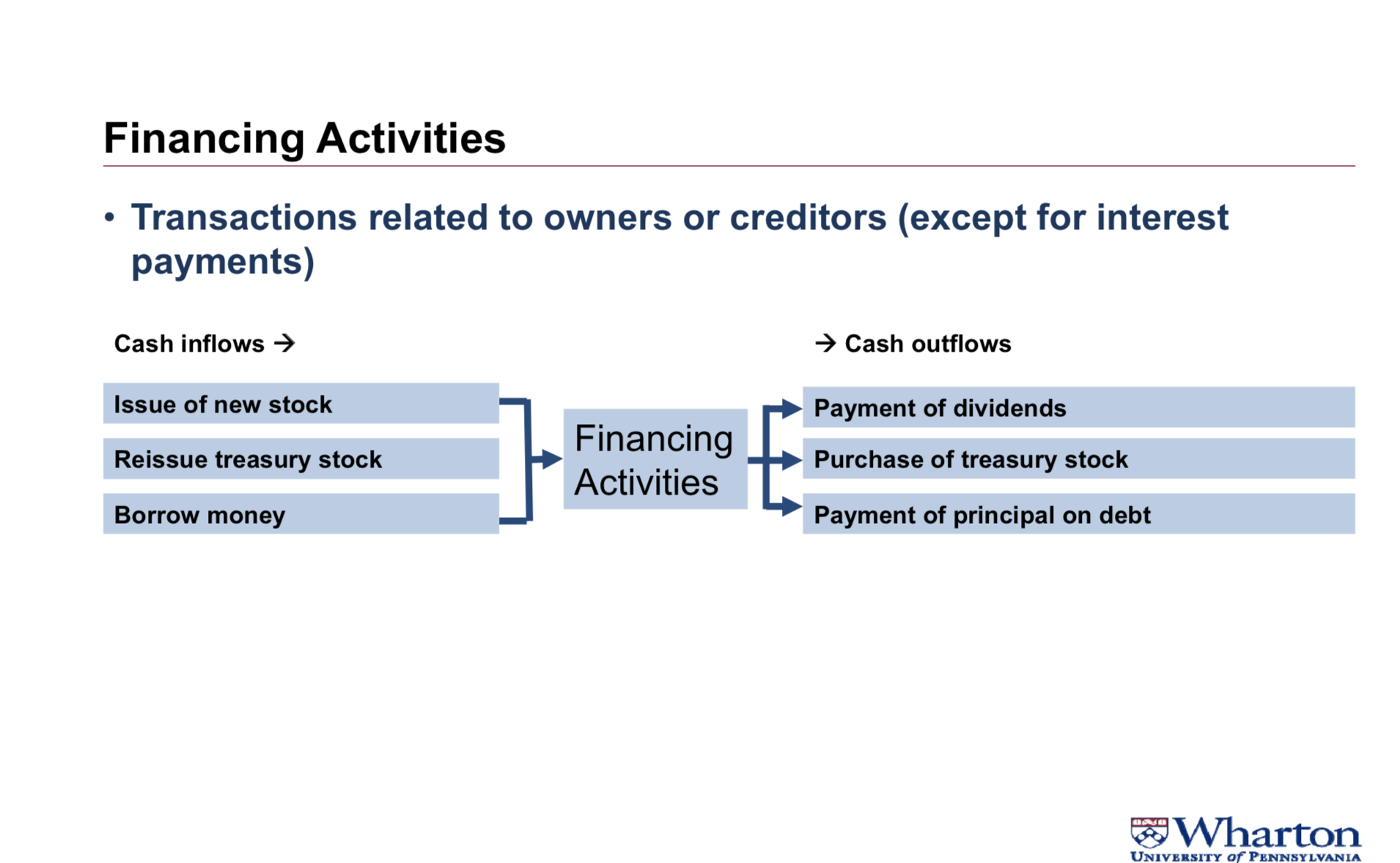

Financing activities

reissue treasury stock: when you take the stock that you previously bought back, called treasury stock, and then sell it back to the public.

payment of principal on debt: not payment of insterest

In HK/IFRS, payment of insterest and dividends can be classified as investing activities

Relic Spotter Case, Part 5

pay for renovation work of building: classified as investing activities:

the key question here is does this expenditure represent a capital improvement, or a routine maintenance? A capital improvement would be anything that increases the value of the building or its useful life. We would add that to the building account, and depreciate it over time, and we’d consider the cashflow an investing activity. Routine maintenance is something you have to do no matter what. It’s already built into the assumptions about the value of the building and its life. It gets expensed immediately and then it would be considered an operating cash flow.

Relic Spotter lent $5,000 cash to Rebecca Park as the loan, which then she has a year to repay.

Relic Spotter is the creditor because Rebecca Park is borrowing money from the company. If the company were borrowing money from Rebecca Park, then yes, it would be a financing activity. So the question now is, if Relic Spotter is lending money to Rebecca Park, is that an operating or an investing activity? I decided to make it an operating activity because the loan was only one year, if the loan was longer than a year, say two years, or three years, or five years. Then I probably would have made it an investing activity, but it’s not a financing activity because the company is the creditor here and if the company is the creditor then it’s not a financing activity.

Relic Spotter paid \$2500 cash to it’s shareholders for it’s dividend.

financing activities

Statement of Cash Flows

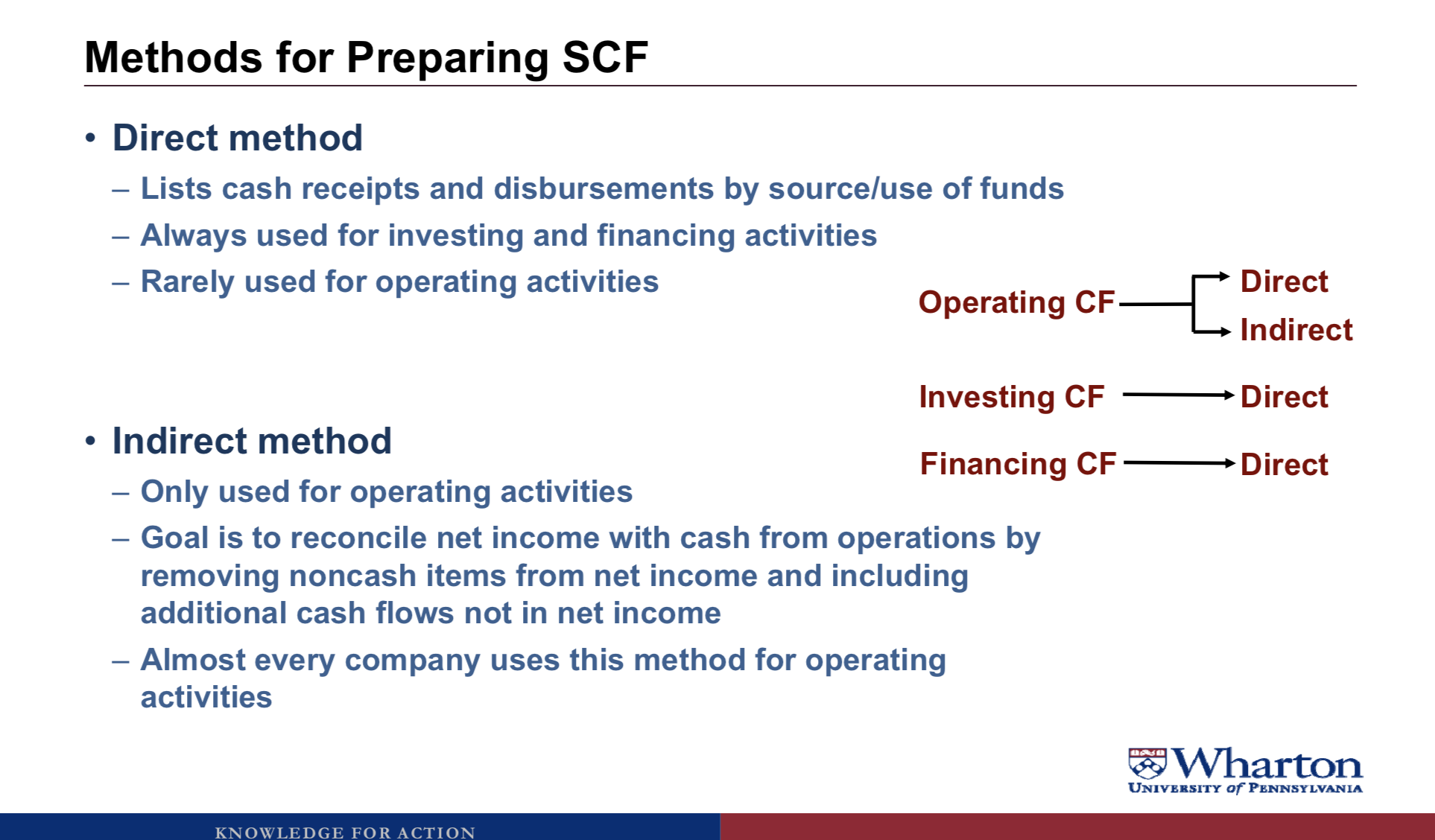

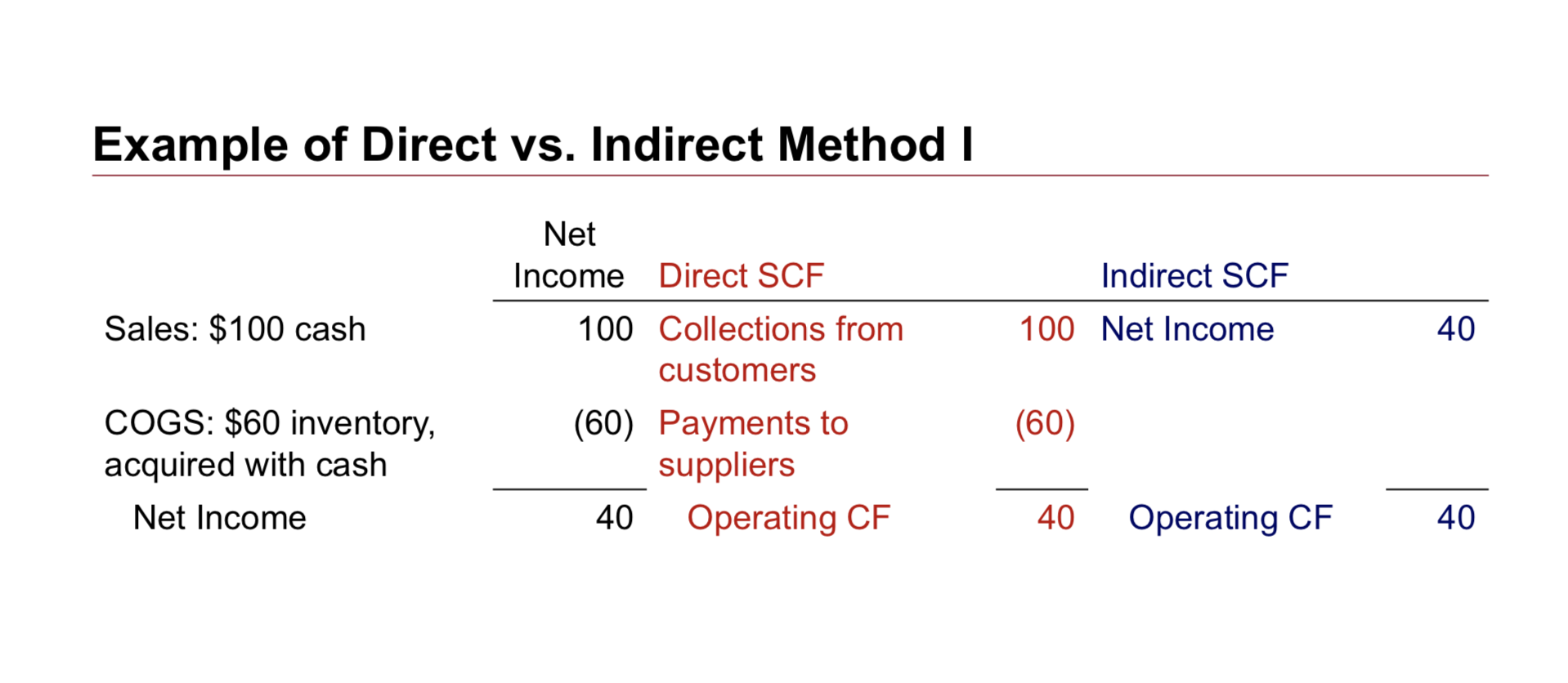

methods to prepare CF statement

Indirect method

• Start with Net Income

Then it’s going to adjust for components of Net Income that are tied to noncash items or to investing activities

• Adjust for components of Net Income tied to noncash items or to investing activities

– Add back expenses or subtract revenues(?)

– Noncash items: Depreciation, amortization

Net income includes depreciation expense and amortization expense which are both noncash expenses. To remove those noncash expenses so that we can get from Net Income to cash from operations, we have to add them back.

– Investing activities: Gains/losses on sale of PP&E or investments

• Adjust for components of Net Income tied to assets or liabilities created through operating activities (i.e., working capital)

– Add or subtract change in asset/liability account balance

– Use the balance sheet equation to determine whether to add or subtract:

Cash + Noncash Assets = Liabilities + Owners’ Equity

For example, accounts receivable is a noncash asset. If accounts receivable went up, we would need to subtract it on the cash flow statement to stay in balance. Inventory’s a noncash asset. If it went down, we would need to add it on the cash flow statement to stay in balance. On the other side of the equation, accounts payable is a liability. If accounts payable went up, we would need to add it on the cash flow statement to stay in balance. And if something like interest payable or wages payable went down, we’d have a liability going down, and we would have to subtract it on the cash flow statement.

Accounts receivable is a noncash asset.

Accounts payable is a liability

Examples:

Note:

Indirect method starts with net income

Important: changes in depreciation for tax purposes actually can save on taxes and can effect cash flow. But that’s a topic that we’re going to deal with much later in the course.

when we do a cash flow statement, we need the change in the balances, the difference between the beginning balance and the ending balance.

Operating cash flow using indirect method tells us more information about company operations(more useful when we do analysis)

we can take a look at company’s investing/financiang and operating cash flow to get a sense to see what stage the company is at.

gain or loss on PPE

• Sell PPE worth \$70 on books for \$75 cash

• Gain of \$5 goes on income statement

• But all \$75 of cash is considered Investing

not a core business activity, it’s gonna be an investing activity. And because it’s an investing activity, we need to remove that gain out of the operating section and place it into the investing section.

And because it’s an investing activity, we need to remove that gain out of the operating section and place it into the investing section.

Disagreement over FASB Classification

• Many investors and analysts prefer to classify

– Interest payments as a financing activity

Cash paid for interest must be disclosed

– Interest and dividends received as an investment activity

• All income tax effects are shown in the operating section, even if the income relates to financing or investing activities

– Cash taxes must be disclosed

EBITDA, Earnings, and Cash Flows

• EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is often used as a proxy for cash flow that excludes interest and taxes

– However, EBITDA does not measure cash flow well if there are large changes in working capital and suffers from the same manipulation potential as net income

– For example, “channel stuffing” would increase earnings and EBITDA, but no cash is collected (instead, accounts receivable increase). Subtracting the increase in AR from EBITDA would correct this problem

• Research finds that Earnings are a better predictor of future cash flow than current Cash Flow from Operations

– But using both gives the best predictions

channel stuffing:

a situation where at the end of a quarter, the company’s trying to meet an earnings target, so they ship a bunch of product to customers in order to book the revenue, which would then increase earnings, and of course then increase EBITDA. But there’s no cash that’s collected. The customers haven’t paid us yet. Instead, accounts receivable will go up. So, EBITDA would consider this channel stuffing as a cash flow, but it’s not a cash flow.ow, if we took EBITDA, and adjusted for this increase in accounts receivable, then we would have a good measure of cash flow.

FCF:

Operating cash flow minus cash for long-term investments

dealing with future losses

when a company anticipates future loses, they have to recognize an expense for them today.

calculate cash flow

So to get a really good cash from operations number, I would suggest one of the two following approaches. Either calculate EBITDARGL and then adjust for all the changes in working capital, or take net cash from operations and then add back the cash interest and cash taxes to remove those two. But you have to do one of those two approaches. Taking either EBITDARGAL on its own or net cash and operations on its own is not gonna give you the number you want if you’re gonna take this and put it into a free cash flow model.